Why you should use HubSpot for your Insurance agency?

HubSpot is a widely recognized CRM, and we've helped agencies just like yours use it to scale your monthly closed policy premium and retain policyholders. When it comes to insurance marketing, sales and servicing there are multiple reasons why HubSpot is the right choice.

1. A user interface any agent can learn how to use

Let's face it, there are too many complicated softwares, with too many options and medieval looking user interfaces.

One thing that really sets HubSpot apart from other CRM options is how easy it is to use. The design of the software makes doing complicated work, a breeze.

HubSpot's product team and executive team really took the time and energy to build something that was going to be easy to use. From marketing to new personal line contacts, to binding new policies, doing it HubSpot is super simple.

Not only does this help speed up ramp times for your agents and relationship managers, but it makes servicing your policy holders much easier.

You might be wondering how it can do this? Well you can customize the operational experience to show relevant data, run processes easily, and ultimately scale quicker. See some examples on our HubSpot for the insurance industry page.

The reason why this is #1, is because of how powerful easy to use software is. We may overlook this, and when other softwares have industry specific built in features it can look more relevant, but often the experience is poor, the platforms are slow and training becomes a nightmare. This reduces a lot of efficiency gains, and hence why having a great UI/UX is critical.

2. Enhance your personalization strategy for selling insurance products

One great feature of HubSpot is it's personalization. Having your data in the same spot means that you can personalize literally everything in the customer journey.

Want to market a specific insurance product to one group of people, but something different to another? Well, HubSpot gives you the flexibility to customize that.

How can you do this? When building content in HubSpot you can use personalization tokens. Quickly add these to landing pages, website pages, and emails to personalize and tailor your customers journey based on the real time data.

This data can be used in even more powerful ways too, like automatically populating forms for agents when they are binding or servicing policies, giving you even more efficiency gains.

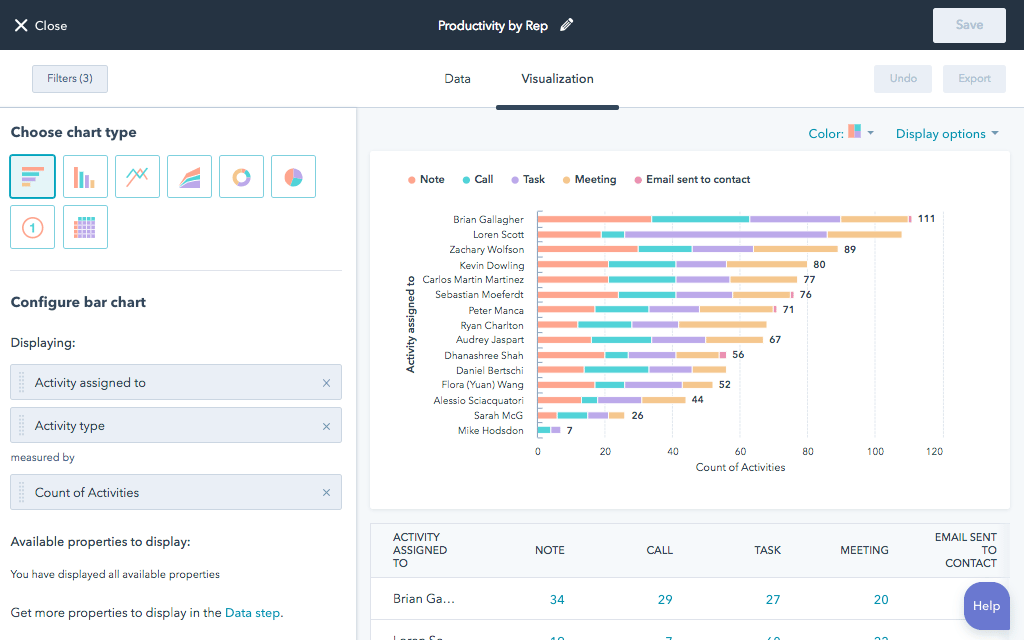

3. Easily report on your key metrics like retention rate, average policy size, bind rate and more.

HubSpot dashboards bring your reports to life. Get daily, weekly and monthly dashboards showing the health and progress of your insurance agency.

Since you can utilize HubSpot for pretty much all of your business operations, you can report on them all from one easy spot too. You can report on different insurance office locations, products, teams, agents, and more.

4. Bind More Policies

Ultimately, HubSpot allows your sales teams to bind more policies. Agents can track all interactions with clients, including phone calls, emails, and messaging allowing them to understand which insurance products they are interested in. This activity data can then be used to target clients more effectively in marketing campaigns, and bind more policies in the sales pipeline. HubSpot is perfect for an insurance agency that is looking to grow quickly and optimize for the future. Read more about HubSpot for insurance companies on HubSpot's website.

.png?width=320&height=80&name=Nobis%20Link%20(1).png)